nj property tax relief homestead benefit

The report ANCHORs Aweigh. File Online or by Phone.

Mccombs Clean Energy Research Hub A Temple For The Clean Tech Entrepreneurs Energy Research Clean Energy Technology

You met the 2018 income requirements.

. 1-877-658-2972 When you complete your application you will receive a confirmation number. 75000 or less for homeowners under age 65 and not blind or disabled. Phil Murphy announced Thursday his administration will extend property tax relief to about 18 million New Jersey households by.

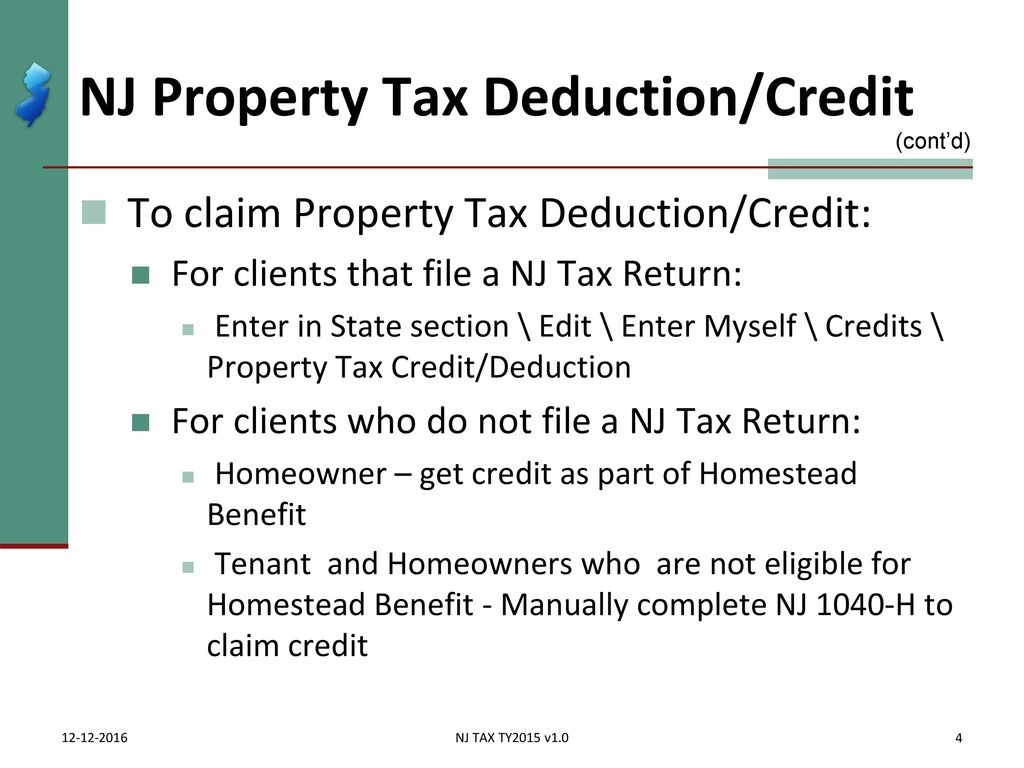

Nows the time to apply for bigger Homestead relief benefits. See Homestead Benefit Program for more information or you can call 1-888-238-1233 Monday through Friday except State holidays. The program provides property tax relief to eligible homeowners and for most homeowners the benefit is distributed to your municipality in the form of a credit that reduces your property taxes.

Funding for the property tax relief program. Ad 2022 Homeowner Relief Program is Giving a One Time 3627 StimuIus Check. If you did not receive a 2018 Homestead Benefit mailer and you owned a home in New Jersey on October 1 2018 that was your main home call the number above for help.

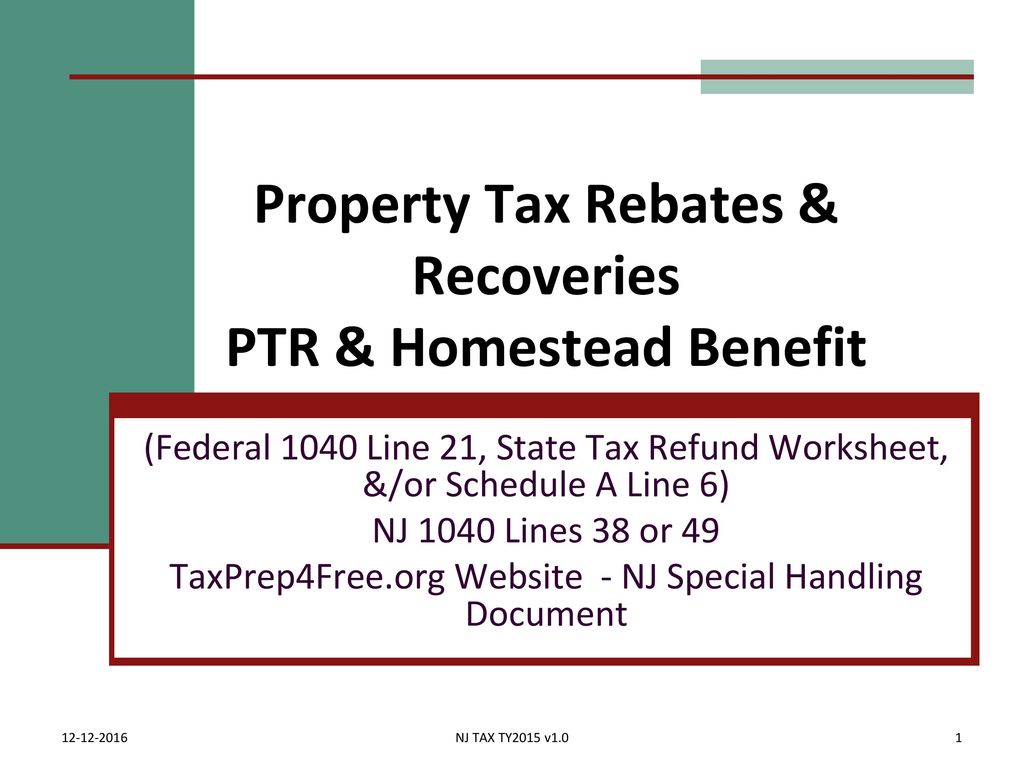

The Homestead Benefit will reduce the tax bill of the person who owns the property on the date the benefit is paid. New Jersey homeowners will not receive Homestead property tax credits on their Nov. This means that if you indicated you still own the home when filing your application and later sell it the only way to receive your 2018 Homestead Benefit is to take credit for the benefit at the closing of your property sale.

Mortgage Relief Program is Giving 3708 Back to Homeowners. Under a proposal Murphy unveiled Thursday New Jersey homeowners making up to 250000 annually would be eligible to receive state-funded property-tax relief benefits. We can deduct any amount you owe from future Homestead Benefits or Income Tax refunds or credits before we issue the payment.

Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. Check Your Eligibility Today. Under Age 65 and not Disabled Homeowners.

4 rows Amounts you receive under the Homestead Benefit Program are in addition to the States other. Ad Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility. Thousands of New Jersey homeowners have begun receiving applications from the state Department of.

New Jersey just increased funding for a key state property-tax relief program and this month homeowners across the state are getting their first opportunity to apply for those beefed-up tax breaks. 1 real estate tax bills a state treasury official said Wednesday. Property Tax Relief Programs.

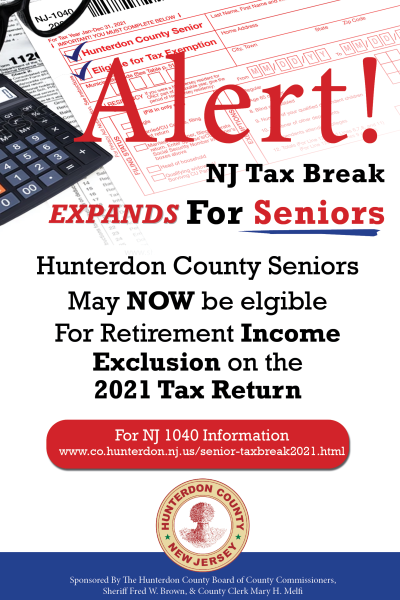

That would add at least 100000 to the current income cutoffs for direct property-tax relief benefits. The filing deadline for the latest Homestead Benefit Application - Tax Year 2018 - was November 30 2021. Certain seniordisabled homeowners who were not required to file a 2018 New Jersey Income Tax return will have their Property Tax Credit included with the Homestead Benefit.

Under Murphys plan homeowners making up to 250000 annually would qualify for direct property-tax relief benefits averaging roughly 680. 150000 or less for homeowners age 65 or over or blind or disabled. Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281.

Explaining Governor Murphys New Property Tax Relief Program outlines the size and scope of the tax relief proposal how it stacks up against the existing Homestead Benefit program and highlights who benefits the most from it. If you were not a homeowner on October 1 2018 you are not eligible for a Homestead Benefit even if you owned a home for part of the year. Currently the average property tax benefit is 626 with eligibility limited to homeowners making 75000 or less if theyre under 65 and not blind or disabled.

Despite the new name ANCHOR is really an expansion of the Homestead Benefit program which provides property tax relief to homeowners who earn up to 75000 per year as well as seniors and those who meet the states definition. However the total of all property tax relief benefits that you receive for 2021 Senior Freeze Homestead Benefit Property Tax Deduction for senior citizensdisabled persons and Property Tax Deduction for veterans cannot be more than the amount of your 2021 property taxes or rentsite fees constituting property taxes. The current Homestead program funds direct benefits that total closer to 630 with those benefits only provided to senior and disabled homeowners earning up 150000 annually and all other homeowners earning up to.

If you filed a 2017 Homestead Benefit application and you are.

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

Property Tax Relief Programs West Amwell Nj

Ppt New Jersey Property Tax Relief Programs Powerpoint Presentation Free Download Id 4440099

1 8m Eligible For Proposed Nj Property Tax Relief Program Murphy Across New Jersey Nj Patch

Senior Freeze Homestead Benefit Programs River Vale Nj

Memoli Company Pc Home Facebook

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

Facts And Information About Geothermal Energy Geothermal Energy Energy Facts Green Renewable Energy

Nj Property Tax Relief Program Updates Access Wealth

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

Nj Governor Unveils Anchor Property Tax Relief Program Morristown Nj News Tapinto

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

Governor Phil Murphy Tax Relief Is A Critical Component Of A Stronger And Fairer New Jersey With Middle Class Tax Rebates An Expansion Of Our Earned Income Tax Credit The Long Overdue Updating

Property Tax Deduction Credit Eligibility Requirements All The Following Must Be Met You Must Have Been Domiciled And Maintained A Principal Residence Ppt Download

When It Comes To Estate Planning It Pays To Consider Each And Every Option For Protecting Your Legacy One Of The Be Estate Planning Life Estate Things To Come