working capital turnover ratio ideal

What is Capital Turnover. WC Turnover Ratio Revenue Average Working Capital.

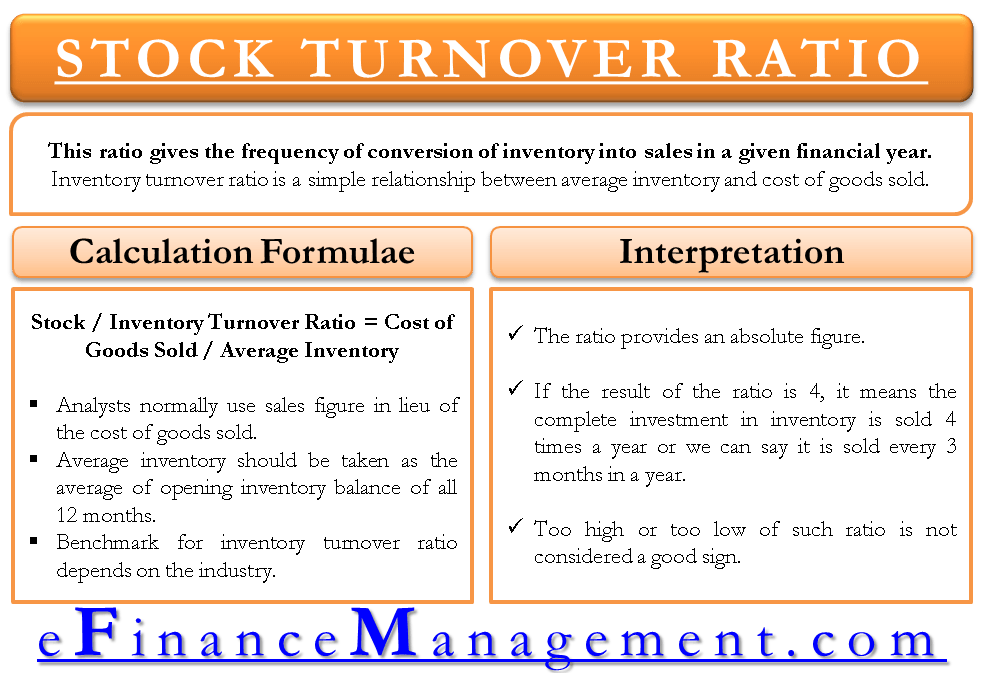

Stock Inventory Turnover Ratio Calculate Formula Benchmark

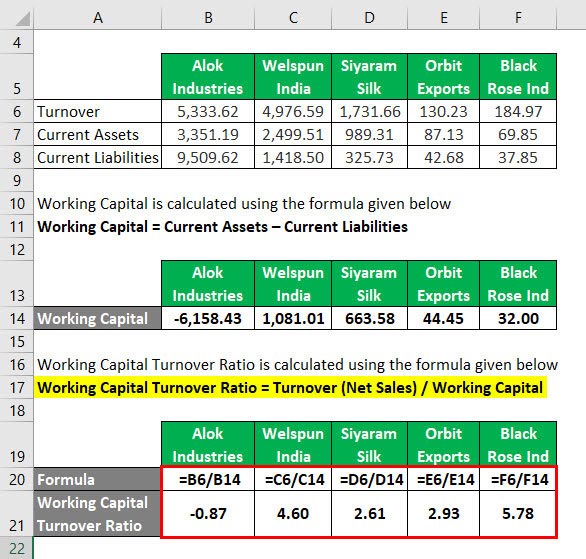

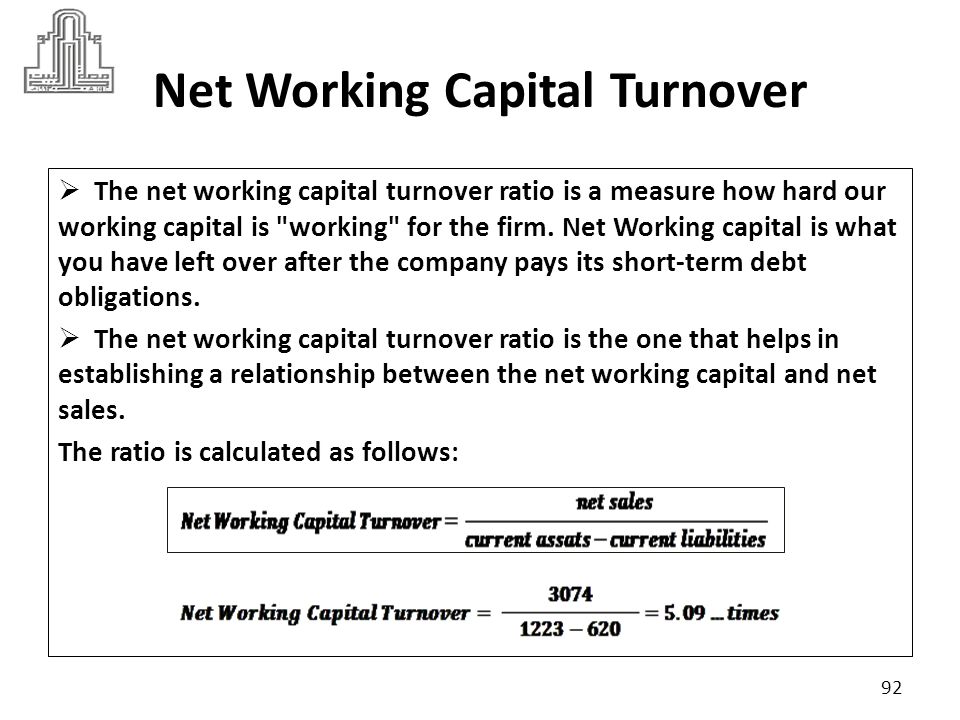

Working capital turnover ratio Formula- Working capital turnover measures how effective a business is at generating sales for every dollar of working capital put to use.

. Things to look out for with your stock turnover calculation include. 15000050000 31 or 31 or 3 Times. It indicates a companys effectiveness in using its working capital.

The working capital turnover ratio will be 1200000200000 6. It means each dollar invested in working capital has contributed 214 towards total sales revenue. The formula to determine the companys working capital turnover ratio is as follows.

This shows that for every 1 unit of working capital employed the. The ideal inventory ratio for most organizations is between 5 and 10. The following formula is used to measure the ratio.

Working Capital Turnover Ratio Net SalesWorking Capital. Multiply the days in a normal working week for you by 56. The ideal quick ratio is considered to be 11 so that the firm is able.

Hence there is obviously an assumption that working capital and. 514405 -17219. The working capital to sales ratio uses the working capital and sales figures from the previous years financial statements.

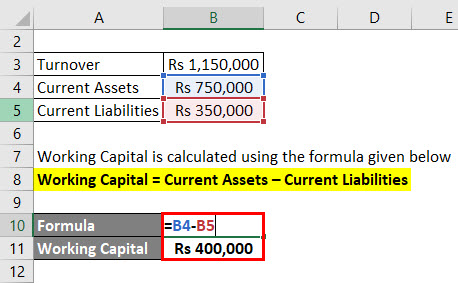

Working capital can be calculated by. Working Capital Turnover Ratio Rs 1150000 Rs 400000. For 2018 total returns equaled just over 8 billion.

A working capital turnover ratio of 6 indicates that the company is generating 6 for every 1 of working. This means that XYZ Companys working capital turnover ratio for the calendar year was 2. The formula for calculating this ratio is by.

Capital turnover is the measure that indicates an organizations efficiency about the utilization of capital employed in the business and it is calculated as a. Capital Turnover Ratio indicates the efficiency of the organization with which the capital employed is being utilized. As clearly evident Walmart has a negative Working capital turnover ratio of -299 times.

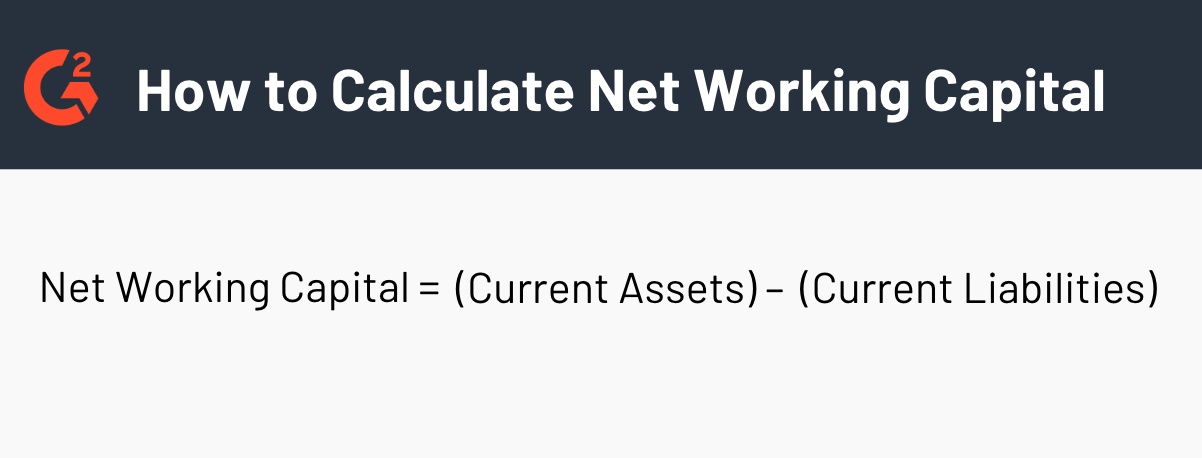

The companys working capital is the difference between the current assets and current liabilities of a company. It signifies how well a company is generating its sales concerning the working capital. The working capital turnover ratio is also referred to as net sales to working capital.

The ratio is calculated by dividing current assets by current liabilities. Company B 2850 -180 -158x. Generally a ratio of 04 40 percent or lower is considered a good debt ratio.

This implies that sales and stock replenishment is made. It is also referred to as the current ratio. Value of stock x 365.

A D V E R T I S E. Working capital is current assets minus. Putting the values in the formula of working capital turnover ratio we get.

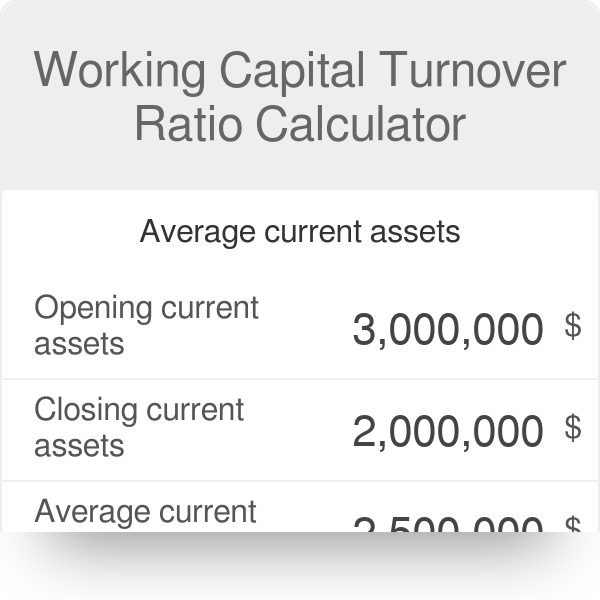

A high capital turnover ratio indicates the capability of the. Now working capital Current assets Current liabilities. Working Capital Turnover 8 billion 148 billion 125 billion 2 The working capital turnover ratio for 2018 was.

The working capital turnover ratio of Exide company is 214. 100000 40000. Answer 1 of 3.

Determining a Good Working Capital Ratio. 150000 divided by 75000 2. Working capital turnover is a measurement comparing the depletion of working capital used to fund operations and purchase inventory which is then converted into sales revenue for the company.

What is the Best Inventory Turnover Ratio. The formula to measure the working capital turnover ratio is as follows. Stock turnover is calculated in a very similar way to the other ratios.

A ratio of 2 is typically an indicator that the. Working Capital Turnover Ratio Formula. The working capital turnover ratio measures how well a company is utilizing its working capital to support a given level of sales.

Hence the Working Capital Turnover ratio is 288 times which means that for every sale of the unit 288 Working Capital is utilized for the period. Working capital turnover ratio Net Sales Average working capital. Working Capital Turnover Ratio Turnover Net Sales Working Capital.

Working Capital Turnover Ratio 288. A ratio above 06 is generally considered to be a poor ratio since theres a risk that the business.

What Is Net Working Capital How To Calculate Nwc Formula

Activity Ratio Formula And Turnover Efficiency Metrics

Asset Turnover Ratio Formula And Excel Calculator

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Calculator

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Ratio Analysis Example Of Working Capital Ratio

Capital Turnover Definition Formula Calculation

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Cycle Efinancemanagement

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Formula Calculator Excel Template

Dr Marie Bani Khalid Dr Mari E Banikhaled Ppt Download

Working Capital Turnover Ratio College Adventures Interpretation Ratio

Working Capital Turnover Ratio Meaning Formula Calculation

Days Working Capital Formula Calculate Example Investor S Analysis

How To Calculate Working Capital Turnover Ratio Flow Capital