what taxes do i pay after retirement

The income is not received right away so taxes are not paid when this income is earned. Your after-tax contributions allow you to receive funds tax-free in retirement as long as you have owned the account for at least five years.

A New Report Analyzes How Each State Taxes Or Does Not Tax Social Security Income Social Security Benefits State Tax Social Security

Both your income from these pension.

. The good news is. Get Hassle-Free Rollover Help From Start To Finish. Distributions from 401 k and traditional IRA accounts are.

Ad Looking for income tax on retirement income. Ax T Withholding You can. Wealthier retirees also miss out on a state income tax.

In the case of a 34000 combined income you can be required to pay income tax up to 85 of your income. What taxes do you pay after retirement. On the income tax front seniors pay tax on their Social Security benefits if their federal adjusted gross is too high.

You can expect to pay taxes. Expect to get hit with taxes on your retirement income from. IRA and 401 k.

What taxes do you pay after retirement. A single person making between 0 and 9325 the tax rate is 10 of taxable income. Ad If you have a 500000 portfolio get this must-read guide by Fisher Investments.

The IRS will withhold 20 of your early withdrawal amount. Currently federal income tax rates range from 10 to 37 percent depending on your income level and marital status. How To Estimate Taxes in Retirement Social Security Income.

There are two ways which taxes are typically paid. If you file as an individual and your income is between 25000 and 34000 50 of your benefits will be taxed. Do not neglect to discuss tax planning when you sit down with your estate planning.

Yes Youll Still Pay Taxes After Retirement And It Might Be a Big Budget Item The average American pays about 10500 a year in total income taxes federal state and. For a single person making between 9325 and 37950 its 15. Schwab Makes It Easy To Roll Over A 401k In Three Steps.

You probably wont pay any taxes in retirement if Social Security benefits are your only source. Balance retirement funds taxes with your overall retirement plan to try to minimize taxes. Our tax law provides for a pay-as-you-go system which requires taxes to be paid on income as it is received.

You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs 401ks 403bs and. For example if you make an early withdrawal of 10000 at age 40 from your 401 k you will get about 8000. What Taxes Do I Pay On Retirement.

Up to 85 of your Social Security benefits may be taxable depending on your total income and your filing status. Ad Understand Your 401k Options. A single person making between 0 and 9325 the tax rate is 10 of taxable income.

What Do I Need To Know About Taxes And Retirement. Depending on your earnings your. Content updated daily for income tax on retirement income.

If your employer has financed your pension plan your retirement income is taxable. How much tax will I pay on my retirement pension. Read this guide to learn ways to avoid running out of money in retirement.

Once you collect this income even after retirement it is then subject to income taxes. Any amount over 34000 will qualify 85 of your benefits to be. The rest of the.

Analysis The State Of The American Tax System In 8 Charts Tax Retirement Planning System

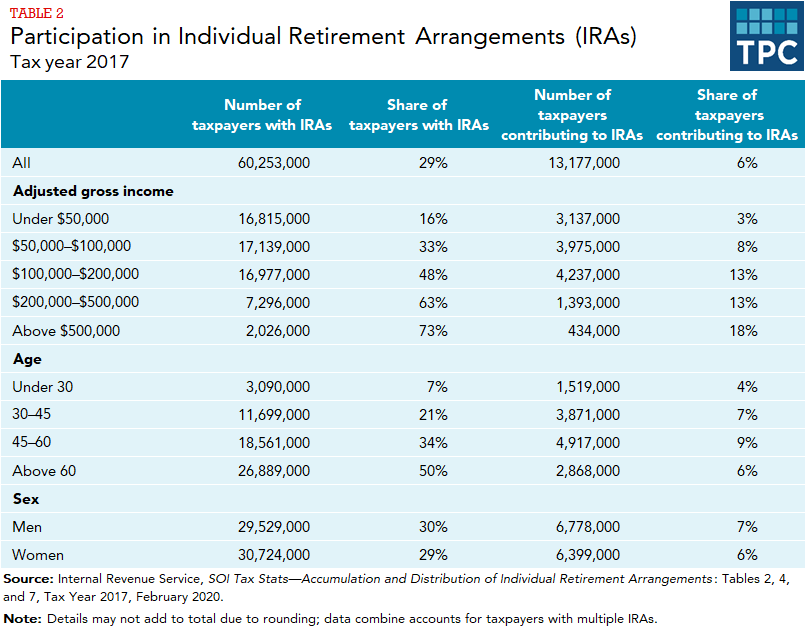

What Kinds Of Tax Favored Retirement Arrangements Are There Tax Policy Center

10 Least Tax Friendly States For Retirees States And Capitals Retirement Funny Retirement Gifts

Withdrawals Of Pre Tax Money Including Contributions Employer Match Profit Sharing And Rollovers In A Workplace Retirement Benefits Tax Money Contribution

The Following Scenarios Can Help You Decide If You Need To Use The Irs S Non Filers Enter Payment I Tax Money Retirement Benefits Supplemental Security Income

3 Ways You Might Tithe In Retirement And A Tip For Saving Big On Taxes Tithing Financial Advice Retirement Income

How Much Money You Take Home From A 100 000 Salary After Taxes Depending On Where You Live Salary Life Money Hacks Smart Money

Here S The Formula For Paying No Federal Income Taxes On 100 000 A Year Marketwatch Federal Income Tax Income Tax Income

Free Retirement Planning Resources Tenon Financial In 2021 Retirement Planning Retirement Resources

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Working In Retirement Social Security Taxes Fidelity Social Security Retirement Social Security Benefits

Savvy Tax Withdrawals Fidelity Financial Fitness Tax Brackets Traditional Ira

States That Won T Tax Your Retirement Distributions Retirement Retirement Income Tax

Social Security Will You Be Taxed Ideas To Help Minimize The Impact Ticker Tape Retirement Financial Planning Social Security Social Security Benefits

State By State Guide To Taxes On Retirees Retirement Income Income Tax Retirement

How To Access Retirement Funds Early Retirement Fund Investing For Retirement Early Retirement

Top 3 Benefits Of Roth Ira Individual Retirement Account Individual Retirement Account Ira Retirement Accounts

5 Last Minute Tax Tips Know Your Deadline 1 In 4 Taxpayers Wait Until The Last Two Weeks To File Taxes Learn What The Differe Tax Refund Diy Taxes Tax Time

What Kinds Of Tax Favored Retirement Arrangements Are There Tax Policy Center